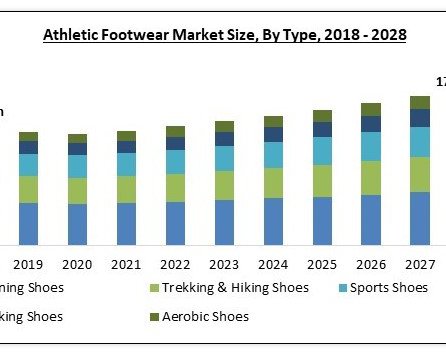

The Global Athletic Footwear Market size is expected to reach $171.9 billion by 2028, rising at a market growth of 4.7% CAGR during the forecast period. [ "Global Athletic Footwear Market Size, Share & Industry Trends Analysis Report By Type (Running Shoes, Trekking & Hiking Shoes, Sports Shoes, Walking Shoes), By End User, By Regional Outlook and Forecast, 2022-2028" - ResearchAndMarkets.com]

Athletic footwear refers to shoes that are designed for sports and other outdoor activities. People of all ages are wearing these as casual and fashion footwear. To meet the requirements and purchasing capacity of individual clients, there is a wide availability of footwear with colour, design, and pricing options.

Athletic footwear is a generic term for shoes that are designed to be worn while participating in sports. Sports shoes are primarily intended for use in active sports or other types of physical activity. They are necessary for athletes because they give flexibility, stability or motion control, road traction, torsional stability, and other advantages. Because of the expanding number of sporting competitions, demand for the product is increasing at a rapid pace. Furthermore, sports like football, baseball, hockey, and others attract a large number of participants, propelling market expansion. Cricket has seen active involvement from both males and females, as per the Australian National Cricket Census. Furthermore, approximately 1.5 million Australians participate in cricket programs or competitions. As a result, an increase in the number of people participating in sports is anticipated to boost the market.

Nike, Inc., Adidas AG, Skechers USA, Inc., and New Balance Athletics, Inc. are among the market's leading players, focused on creating revolutionary technologies to improve the stability and comfort of sports shoes. Adidas AG, for example, has developed a Forged Mesh, a single-layer shoe upper with a ribbed pattern built utilising ARAMIS motion capture technology to determine foot strain. To enable unfettered foot mobility, the technology helps offer optimum flexibility and suitable support along the ankle. Adaptive Traxion, Boost, Bounce, Climachill, Promeknit, and Stableframe are some of Adidas AG's other proprietary innovations.

COVID-19 Impact Analysis

Covid-19 has had a big impact on the sports footwear and apparel industries in the United States. In terms of brands, Nike brand footwear sales were down in the high teens, Jordan brand footwear was down in the low teens, and Converse sales were down by more than 30%. Adidas, Skechers, ASICS, and Vans all saw a drop in the teens, while Under Armour had a 25% drop and Fila saw a nearly 50% drop. The global athletic footwear market has been severely impacted by the COVID-19 pandemic. Due to the closure of key distribution routes around the world in an attempt to limit the spread of coronavirus, the COVID-19 pandemic had a substantial impact on the supermarkets/hypermarkets category.

Market Growth Factors:

The rise in the number of Government initiatives

Consumers" expanding purchasing power and disposable incomes have become crucial trends in the industry. As people's income levels rise, they"re more willing to pay more for certain performance qualities including waterproofing, moisture management, temperature control, and friction regulation. Moreover, the growing number of different retail locations, hypermarkets, and supermarkets is expected to impact the market in the upcoming years. Global, regional, and municipal governments are focusing on health and developing innovative tactics to raise people's attention to the benefits of physical activity. Several wealthy countries" government bodies are continually working to build enticing healthcare offers. This will generate a higher demand for athletic footwear at the same time, as a large section of the population will be interested in sports and fitness activities.

Increasing participation in sports and physical activities

The global market is characterized by the rising prevalence of chronic diseases due to a lack of activity and a growing health-conscious population, particularly in metropolitan areas. In addition, sports shoe demand is expected to rise as more emerging countries focus on creating gyms and sports infrastructure. According to the 2019 International Health & Fitness Association Report, the global fitness club membership grew by 183 million people. In recent years, there has been an increased sports involvement by children and teenagers.

Marketing Restraining Factor:

Availability of low-cost local products

The manufacturers in the market is expected to witness many challenges including a lack of sports possibilities and a reduced penetration of high-cost sports footwear in rural areas and low-income countries. In addition, the availability of low-cost counterfeit products, as well as the rise of various small-scale market participants, has created a threat to high-priced branded footwear. Moreover, there are many local players in many countries who are offering similar types of shoes at low-cost in order to entice young consumers, thereby posing a big challenge for the established industry players.

Type Outlook

Based on Type, the market is segmented into Running Shoes, Trekking & Hiking Shoes, Sports Shoes, Walking Shoes, and Aerobic Shoes. The Trekking & Hiking Shoe segment obtained a significant revenue share of the Athletic Footwear Market in 2021. This is because of technical improvements in these shoes that have assured improved comfort and flexibility for hikers. For example, in collaboration with Salewa, W.L. Gore & Associates, Inc. introduced the first iteration of surround technology. GORE-TEX laminates are integrated into the shoe upper of trekking and hiking shoes to encircle the foot from all sides and expel sweat and heat through side ventilation.

End-User Outlook

Based on End User, the market is segmented into Men, Women, and Children. In 2021, the Men segment garnered the highest revenue share of the Athletic Footwear Market. This is credited to the male population's proclivity for sports and other physical activities. According to the United States Bureau of Labor Statistics, males spent an average of 5.7 hours in sports activities per day in 2018, while women spent 4.9 hours. In addition, the percentage of male as compared to women in major sports are high, hence boosting the demand for athletic footwear among men.

Regional Outlook

Based on Regions, the market is segmented into North America, Europe, Asia Pacific, and Latin America, Middle East & Africa. In 2021, Asia Pacific emerged as the leading region in the overall Athletic Footwear Market. Increased levels of disposable income and increased e-commerce penetration are predicted to fuel demand for sports footwear in the Asia Pacific. Increasing interest in participation in various sporting events, such as the Asian Games, the ICC Cricket World Cup, and the ACC Asia Cup, is aiding the regional market's expansion.

Athletic Footwear Market Competition Analysis

The major strategies followed by the market participants are Product Launches. Based on the Analysis presented in the Cardinal matrix; Nike, Inc. are the forerunners in the Athletic Footwear Market. Companies such as FILA Holdings Corporation and Under Armour, Inc. are some of the key innovators in the Market.

The market research report covers the analysis of key stakeholders of the market. Key companies profiled in the report include Adidas AG, ASICS Corporation, FILA Holdings Corporation, Under Armour, Inc., Nike, Inc., PUMA SE, VF Corporation, Lotto Sport Italia Spa, and New Balance Athletics, Inc.

Recent Strategies Deployed in Athletic Footwear Market

Partnerships, Collaborations and Agreements:

- Mar-2022: PUMA SAFETY formed a partnership with Shoes For Crews, the global leader and pioneer in slip-resistant footwear. Together, the companies aimed to transform the future of athletic security starting with a line of advanced slip-resistant enterprise safety footwear.

- Feb-2022: FILA formed a partnership with KROST, an American-based brand awareness brand. Through this partnership, the companies aimed to introduce KROST x FILA, upraised apparel, accessories, and footwear collection featuring superior materials and fabrics. Additionally, the new capsule offers FILA's iconic convention with its use of classic silhouettes and the brand's trademark red, white, and navy hues, while preserving the sharp clean aesthetic built within KROST.

- Feb-2022: New Balance Athletics formed a partnership with Myntra, an Indian fashion e-commerce company. Through this partnership, New Balance aimed to launch a variety of products including women and men across bags, apparel, footwear, and sports accessories on Myntra. Additionally, the partnership is expected to give a compelling jump to the growing domestic sports and fitness division as it opens up one of the largest markets to the leading brand, assuming Myntra's booming consumer base and dept reach, while also providing a dominant brand in the global fitness and sports.

- Apr-2021: New Balance Athletics came into a partnership with Boston College Eagles, the athletic teams that represent Boston College. Through this partnership, New Balance Athletics is expected to be the official Apparel, Footwear and uniforms supplier for the Eagles.

- May-2020: Adidas came into a partnership with Allbirds, a New Zealand-American company that sells footwear and apparel. Through this partnership, the companies aimed to develop production and supply chain procedures and explore renewable element resources. Additionally, together companies aimed to generate less carbon footprint ever registered for a sports performance shoe.

Acquisitions and Mergers:

- Dec-2021: NIKE completed the acquisition of RTFKT, a developer of custom sneakers designed for video game enthusiasts. This acquisition aimed to boost Nike's digital upgradation and enable to serve creators and athletes at the convergence of creativity, culture, gaming, and sports.

Product Launches and Product Expansions:

- Feb-2022: ASICS introduced GEL-NIMBUS 24 running shoe. The ASICS shoes provide enhanced and combined FF BLAST PLUS technology to provide almost 20 grams lighter1 than its ancestor while offering a more empowering toe-off and a softer touch in every step.

- Feb-2021: Nike introduced Go FlyEase, a sports shoe with no laces, zips, or other fastenings. The Go FlyEase offers extended out the shoe and breaks down the back technique.

- Sep-2020: Adidas introduced adizero adios Pro. The shoes offer carbon induce EnergyRods, an all-new innovation that was designed on the award-winning success of the adizero family.