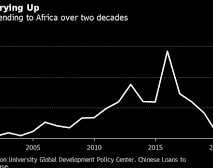

Under the sweeping Belt and Road Initiative, China has broadened economic and political influence across Africa. But Chinese lenders and development banks have grown cautious as economic growth slows and borrowing costs rise. That brought funding for Africa projects down to $7.5 billion last year from $16.5 billion in 2021. Whether investment returns to previous levels will largely depend on China’s economic recovery from its zero-COVID policy, the South China Morning Post reported. The country’s most ambitious years of development finance may be behind it.

Chinese financing and investment in big African infrastructure projects under the Belt and Road Initiative fell to a historical low last year as China cut financing for some big-ticket projects due to debt concerns and shifted capital to other regions.

In the past two decades, China led a financing boom for big infrastructure projects in Africa ranging from ports and hydroelectric dams to highways and airports. But belt and road funding in sub-Saharan Africa dropped 54 per cent last year, to US$7.5 billion from US$16.5 billion in 2021, according to a recent report by the Green Finance and Development Centre, which is part of the Fanhai International School of Finance at Fudan University in Shanghai.

The report said sub-Saharan Africa attracted US$4.5 billion for construction last year, compared with US$8.1 billion in 2021. No new Chinese funding for African railway projects was announced last year, but non-Chinese contractors secured some large deals, including a US$8.7 billion project in Egypt won by German conglomerate Siemens in May.

Chinese investment, mostly by private companies, in belt and road projects in sub-Saharan Africa dropped to US$3 billion last year from US$8.5 billion in 2021, the report said.

The report singled out Angola – a key destination for Chinese capital in the past two decades – which saw belt and road project funding drop from US$310 million in 2021 to zero last year, tracking an Africa-wide trend that started about five years ago as Chinese policy lenders such as the Export-Import Bank of China grew more cautious. Angola was among 14 countries that recorded a 100 per cent drop in belt and road project funding last year, with the others including Nepal, Peru, Russia and Sri Lanka.

The centre’s director, Christoph Nedopil Wang, said China’s financial engagement in some African countries had declined during the Covid-19 pandemic amid new risk evaluations.

Wang said much of China’s financing and investment in Africa had been in the extraction of natural resources and the building of large infrastructure projects, with large investment volumes supported by bank loans.

“With continued sovereign debt issues in some of the African countries, it might be prudent to reduce big-ticket projects to reduce further debt risks,” he said. “This would then lead to lower engagement volumes.

“It does not necessarily mean a withdrawal of Chinese partners in the region, but possibly an engagement in smaller projects.”

Two years ago, Beijing announced it planned to focus on a “small is beautiful” approach to economic engagement that made smaller and more targeted projects a priority.

According to a recent study by the Global Development Policy Centre at Boston University in the United States, while China’s most ambitious years of development finance are behind it, the country has continued to lend in more measured ways, with a growing preference for the provision of high-quality, targeted, “smart and small” support.

Addressing the third belt and road symposium in November 2021, President Xi Jinping said high-quality “small and beautiful” projects, which were sustainable and improved people’s livelihoods, should be a priority in overseas cooperation. China’s central bank has since issued regulations capping external lending by the country’s banks.

The Green Finance and Development Centre report, which is produced annually, found the Belt and Road Initiative had shifted towards smaller, lower-risk projects. The average value of construction projects fell from US$496 million in 2021 to US$330 million last year, the lowest figure since the initiative began.

China’s global belt and road investment held steady at US$67.8 billion last year as Beijing ramped up financing and investment in Arab and Middle Eastern countries. Hungary also became a major beneficiary of Chinese investment due to a decision by China’s Contemporary Amperex Technology to build a US$7.6 billion battery plant in Debrecen.

Global belt and road funding since the initiative’s launch in 2013 has totalled US$962 billion, with about US$573 billion in construction contracts and US$389 billion in non-financial investments.

Kanyi Lui, an international project finance lawyer and head of Pinsent Masons’ China offices, said the lifting of Covid-19 restrictions in China was a positive sign for the belt and road in Africa and globally.

“I do not expect [belt and road] activities in Africa to return to previous levels very quickly,” Lui said. He said most belt and road debt was denominated in US dollars, which meant increases in US interest rates increased borrowing costs, which put stress on borrowers and reduced the appetite for new loans.

Lui said that like all lenders, Chinese lenders were subject to limits on risk concentration and country exposure. For example China was often cited in media reports as being Sri Lanka’s “largest bilateral creditor”, but it only held 10 per cent of Sri Lanka’s external debt, with 80 per cent held by Japan, commercial creditors and multilateral lenders.

“This means jurisdictions which have already borrowed from Chinese lenders have less room to borrow further,” he said. “Over the last decade, some African countries have borrowed significantly from Chinese lenders to fund major infrastructure projects, and major projects and related financings take time to repay.”

Lui said the focus on “small and beautiful” projects and the improved infrastructure built under the Belt and Road Initiative were starting to facilitate further investment in large-scale resources projects and smaller renewable energy, water and manufacturing projects, all of which relied on good basic infrastructure being in place.

The handover ceremony for the Chinese-built Benguela Railway that runs for 1,344km across Angola – from Lobito on the Atlantic coast to the border with the Democratic Republic of the Congo – in Lobito in October 2019. Photo: Xinhua

“High-quality smaller-scale investments that boost local productive capabilities are being encouraged because they not only improve quality of life locally, but also contribute to long-term engagement,” Lui said.

The decline in belt and road funding was ultimately a reflection of the performance of the Chinese and African economies during the third year of the Covid-19 pandemic, said Tim Zajontz, a research fellow at the Centre for International and Comparative Politics at Stellenbosch University in South Africa.

“Low capacity in many African countries to take on new loans has restrained demand in the construction and infrastructure sectors, while Chinese overseas investments have sought markets that are considered less risky and higher yielding,” Zajontz said.

He said Sino-African belt and road cooperation had changed significantly over the past few years.

“While the areas of cooperation have continuously increased, even before the onset of the pandemic Beijing has significantly restricted its loan financing to avoid further political backlash over debt issues,” Zajontz said.

He said economic repercussions of the pandemic had further curtailed Chinese investment in Africa, and any reversal of that trend would depend in large part on how the Chinese economy recovered from its recently abandoned zero-Covid policy.

Zajontz said Beijing would continue to brand all kinds of cultural, political and economic activities in Africa with the belt and road label. But investments and the funding of construction projects would be much more selective and strategic compared to the scattergun approach that was typical in the early years of the initiative.

China is building a new Egyptian capital in the desert under its Belt and Road Initiative

“Project selection will increasingly be informed by geopolitical and geoeconomic considerations, as the Belt and Road Initiative will face growing competition from the EU’s Global Gateway and Washington’s Partnership for Global Infrastructure and Investment,” Zajontz said.

Nevertheless, Wang said, many African countries were likely to remain important belt and road partners for China.

“China, with its relationships and technical capacity, will remain an important contributor to capacity building, infrastructure construction and trade for many African nations,” he said. “With a growing market across Africa, particular investment opportunities can be found, for example, in green energy, manufacturing and resources.”