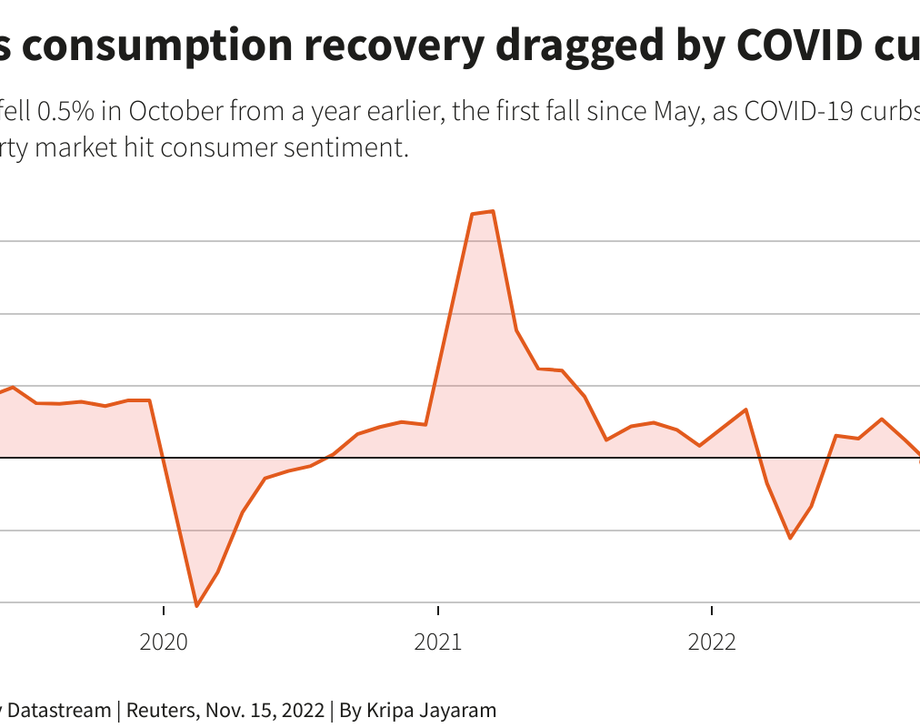

The effect of the pandemic in China, where the intransigent "zero Covid" containment policy imposed in an authoritarian way by the Beijing government continues, is particularly heavy for retail chains. A Reuters dispatch reports that sales fell 0.5%, against expectations of a 1.0% increase and compared to a 2.5% increase in September. On the other hand, the country is missing its annual growth target of 5.5%. A Reuters poll predicts growth of only 3.2% in 2022.

- Retail sales decline for the first time since May, in the following context:

- China's industrial production grows more slowly than expected

- Real estate investments record the biggest decline since the beginning of 2020

- Gloomy economic outlook for weakening external demand

China's economy suffered a broad slowdown in October as factory output grew more slowly than expected and retail sales fell for the first time in five months, underscoring faltering demand at home and abroad.

The world's second-largest economy is facing a series of headwinds including protracted COVID-19 curbs, global recession risks and a property downturn. In a sign of persistent weakness in sector, data on Tuesday also showed property investment falling at its fastest pace since early 2020 in October.

The downbeat data poses a challenge for Chinese policymakers as they steer the $17 trillion dollar economy through choppy waters, following recent moves to ease some COVID curbs and give financial support to the struggling property sector.

"October activity growth broadly slowed and missed market expectations, pointing to a weak start to Q4 as a worsening COVID situation, prolonged property downturn and slower export growth more than offset continued policy stimulus," analysts at Goldman Sachs said in a note.

Industrial output rose 5.0% in October from a year earlier, missing expectations for a 5.2% gain in a Reuters poll and slowing from the 6.3% growth seen in September, data from the National Bureau of Statistics (NBS) showed on Tuesday.

Retail sales, a gauge of consumption, fell for the first time since May, when Shanghai was under a city-wide lockdown. Sales dropped 0.5%, against expectations for a 1.0% rise and compared with a 2.5% gain in September.

COVID outbreaks widened across the country in October, disrupting the pandemic-sensitive services sector, including the restaurant industry. China's catering revenue slumped 8.1%, down sharply from a 1.7% drop in September, NBS data showed.

In response to the weak data, investment bank JPMorgan revised down its year-on-year GDP forecast for China in the fourth quarter to 2.7% from a prior 3.4%, while Citi also trimmed to 3.7% from 4.6% previously.

Domestic COVID containment measures were placing a "huge" pressure on the economy, said NBS spokesperson Fu Linghui, adding that downside risks from the global economy were rising.

"The impact from the triple pressures on economic operations – shrinking demand, supply shocks and weakening expectations – is growing," said Fu at a press conference in Beijing.

The economic outlook remains gloomy despite Beijing's move to ease some COVID curbs, said Zichun Huang, economist at Capital Economics.

"With exports cooling, the property sector still in the doldrums and the zero-COVID policy likely to remain in place longer than many hope, the near-term outlook is gloomy."

Despite the disappointing figures, Chinese stocks rose on Tuesday on signs of easing Sino-U.S. tensions after a meeting between U.S. President Joe Biden and Chinese leader Xi Jinping, while Beijing's latest supportive steps also lifted sentiment.

PROPERTY STILL IN THE DOLDRUMS

Property investment fell 16.0% year-on-year in October -- its biggest drop since January-February 2020, according to Reuters calculations based on NBS data. It slumped 12.1% in September.

Property sales measured by floor area dropped 23.2% year-year in October, falling for a 15th straight month, with buyers reluctant to take on more debt as the economy slows amid protracted COVID restrictions.

China's property sector has slowed sharply as the government has sought to restrict excessive borrowing. A plan to shore up liquidity outlined by Chinese regulators on Sunday sent Chinese property stocks and bonds soaring on Monday.

Chinese financial regulator said in a notice published on Monday it will allow property developers to access some pre-sale housing funds, in the latest move to relieve the liquidity crunch.

"It is clear that new policies to boost domestic demand are needed to refuel China's fragile recovery. Sluggish consumption and faltering property investment remain dawdlers, due to still-weak expectations on household income and macro growth," said Bruce Pang, chief economist at Jones Lang Lasalle.

Fixed asset investment expanded 5.8% in the first 10 month of the year, versus expectations for a 5.9% rise and growth of 5.9% in January-September.

Hiring remained low among companies growing increasingly wary about their finances.

The nationwide survey-based jobless rate stayed at 5.5% in October, unchanged from September. The survey-based jobless rate in 31 major cities picked up to 6.0% from 5.8% in September.

The country is on track to miss its annual growth target of around 5.5%, analysts say. Economists in a Reuters poll expect the economy to grow 3.2% in 2022.