Chinese shoppers will make up 40% of all luxury consumers by 2030. Gen Z and Gen Alpha luxury spending is expected to grow three times faster than other cohorts. India’s luxury market is forecasted to expand to 3.5 times today’s size by 2030. The global luxury market in 2023 will be more resilient to recession than during the 2009 financial crisis due to a larger consumer base and better balance across regions. All this in the Bain & Co. and Altagamma report, commented by Jing Daily.

Even as economic conditions worsen, the global luxury market marches on. A recent study released by Bain & Co. and Altagamma projects that the industry will reach $1.4 trillion in sales revenue this year, growing 21 percent from 2021. Despite high inflation and rising costs of living, as well as ongoing COVID-19 restrictions, some 95 percent of luxury brands reported positive growth in 2022.

That said, China is still performing below 2021 figures and not expected to recover until the middle of next year. Notably, after previously reporting that Chinese consumers would make up half of the global luxury market by 2025, the global consultancy has amended its forecast: They will represent 40 percent of all luxury consumers by 2030.

“China (and Chinese) are a fundamental growth driver in the long-term,” said Federica Levato, Senior Partner and EMEA Leader Fashion & Luxury at Bain & Co. “The lower incidence forecasted in 2030 versus figures in 2025 has to be found in the unleashing of additional pockets of growth related to mature and emerging markets, and not a slowdown of China and Chinese, which are expected to continue their strong growth trajectory.”

Below, we take a closer look at the factors shaping the global luxury sector — and what brands can do to prepare for a potentially turbulent future.

Old and new markets take center stage

As China remains challenged due to COVID-19 restrictions, other parts of the world have begun to shine. According to Bain, the US luxury market is still leading in size while Europe has managed to surpass pre-pandemic levels thanks to an uptick in local demand and overseas shoppers. In the third quarter, Kering’s sales in Western Europe jumped 74 percent year-onover-year, boosting group-wide revenue to 5.14 billion euros, while LVMH and Hermès posted double-digit growth thanks to strong performances in Europe and the US.

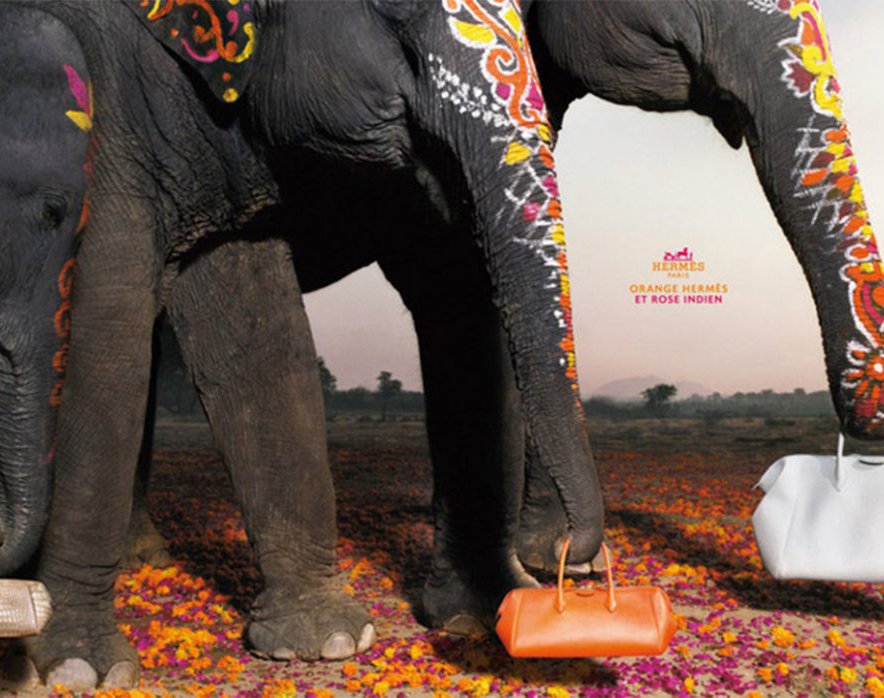

Newer luxury markets have emerged too, including Southeast Asia, although it lacks the infrastructure to facilitate expansion locally. In South Asia, India is a country to keep tabs on, with a luxury market forecasted to swell to 3.5 times today’s size by 2030. In a show of confidence for this trajectory, Aditya Birla Fashion and Retail Limited (ABFRL) recently announced a partnership with Galeries Lafayette to bring luxury department stores to Delhi and Mumbai by 2025.

Luxury consumers are getting younger and pickier

In addition to the geographic shift, the generational one is also critically shaping the space. Bain and Altagamma’s analysis found that Gen Y and Gen Z accounted for the entire growth of the global luxury market in 2022. In the coming years, Gen Z and Gen Alpha spending will grow three times faster than other generations until 2030, when they will make up a whopping one-third of the market.

“[The] impact for brands of these young consumers entering the market will be substantial,” Levato told Jing Daily. “Brands will be asked to adapt their value proposition to the new and evolving Pyramid of Values, where purpose and expanded brand meaning have a central role in order to remain relevant.”

“Brands will be asked to adapt their value proposition to the new and evolving Pyramid of Values, where purpose and expanded brand meaning have a central role in order to remain relevant.”

Evaluating relevance and offerings will be especially important in China, where Gen Alpha has been deeply influenced by the country’s development. “[They are] wealthier than ever, but increasingly isolated,” explained Adam Knight, co-founder of digital agency TONG. “Years of restricted outbound travel, limited study abroad options, and escalating geopolitical tensions are likely to lead to further disengagement with the outside world.”

Although most of Gen Alpha is still under 12-years-old, it’s not too early to start courting this cohort — consumers today are purchasing high-end goods as early as 15-years-old. However, being more “knowledgeable and choosy” as studies found, brands will need to work harder to gain their loyalty.

“Old hat loyalty programs are now being innovated with social incentive schemes,” Knight pointed out. “These flip traditional VIP schemes on their head, incentivizing brand engagement and advocacy pre-purchase rather than post, gamifying the user experience with points rewards for each interaction with a brand to be redeemed against exclusive content and discounts.”

Even if a recession hits, global luxury will be resilient

Supported by these various growth avenues, Bain predicts two scenarios for 2023: Sales of personal luxury goods will either increase 3 percent to 5 percent, or 6 percent to 8 percent at constant exchange rates, depending on the strength of China’s recovery and the ability of the US and Europe to withstand economic headwinds. Regardless of which, Bain believes the luxury market should still be able to withstand the potential recession next year.

Not only does the current industry have a larger consumer base than it did during the 2009 financial crisis — topping 400 million today — but brands have done a better job at developing and balancing business across regions and generations. Furthermore, “brands have been able to nurture their top, ultra-high-net-worth customers, traditionally less impacted by economic downturns,” Levato added. “They constitute a ‘safer’ bucket of sales for brands to rely on, especially during periods of economic pressure.”

Ultimately, big spenders will likely keep on spending in times of economic hardship. And with brands already adept at navigating through turbulence — be it lockdowns or the latest tech trends — they should be able to weather the rocky road ahead.