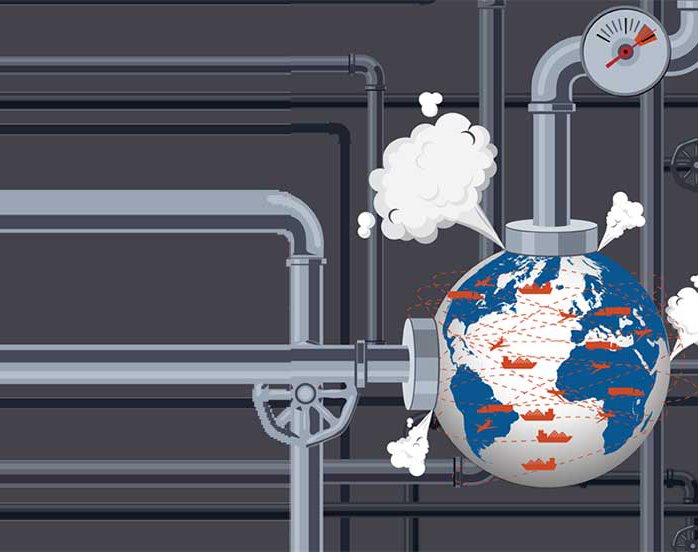

Supply chains worldwide will continue to be caught between politics, economics and ecology in the future. Whether there will be more regionalization or nearshoring remains to be seen. The question will linger: Who will win and who will lose in this increasingly tense competition? [Supply Chain Webinar 2023 - Supply Chain Under Pressure – Logistics Management]

Logistics experts discuss the challenges and prospects for global supply chains in 2023, and it’s clear that a multitude of factors are involved. Many shippers and players in the transport and logistics business are currently under great pressure.

This is due to a number of lingering issues including the pandemic; huge increases in energy prices; large fluctuations in the supply and demand for transport capacities; delays in port trans-shipment; and bottlenecks in hinterland transport. Furthermore, numerous countries are experiencing double-digit inflation.

Russia’s war on Ukraine also has effects on the supply and flows of goods, while disruption of supply chains and the West’s dependence on imports continues to intensify the debate about relations with China. Above all, there’s also the environmental challenge and the question of how to reduce CO2 emissions and deal with the costs for doing so.

And in the midst of these unprecedented challenges, industrial and commercial companies are analyzing their supply chains and searching for optimization tactics and alternatives. One possibility is to go back to more warehousing with the aim of greater stability in the supply of goods of all kinds—which has often not been running smoothly as of late. Still, the economy has no short-term alternative to international production and trade.

As we move forward, it’s clear that global supply chains will continue to not only need exceptional risk management solutions, but also improved climate friendliness. According to experts of the German Freight Forwarding and Logistics Association (DSLV), one thing is certain: the trend is to take every bit of CO2 reduction into account and leverage climate potential step by step wherever sensible and effective.

“Through innovative technology and efficient and digital processes, we need fewer resources and can reduce emissions. Switching to low-emission modes of transport, motors, and fuels is the most important way to further climate protection in the transport sector and logistics,” say DSLV experts.

Freight rates remain high

Just-in-time deliveries, a strategy followed for a long time, can often no longer be reliably guaranteed in many places. High-volume consigners have the advantage of market power to exert pressure on shipowners, port terminals, and transport companies to meet just-in-time delivery schedules.

In addition to delays in deliveries worldwide, the huge increases in freight rates caused problems for shippers last year. For 2023, consigners hope that freight costs will gradually taper down toward pre-pandemic levels.

However, Rolf Habben Jansen, CEO of Hapag Lloyd, pointed out at an online press event that the significant increase in fuel prices will mean that shipping lines will have to reckon with freight rates around 20% to 30% higher than two to three years ago. He expects that shipowners will face difficulties in long-term planning in general and will need to rely more on quarterly adjustments in services and rates.

Major seaports, such as Rotterdam, Europe’s largest port, will respond to increasing costs with moderate price hikes of around 2.5% to 3%, according to Siemons Boudewijn, COO of Port of Rotterdam Authority. Other ports are also expected to implement price increases for 2023.

Gradual introduction of a CO2 levy in the EU

Maritime shipping accounts for around 3% of global CO2 emissions, according to a report published in October 2017 by the International Council on Clean Transportation (ICCT). Around 60,000 larger merchant ships, including around 6,000 container ships, operate on the world’s oceans.

In October 2022, the International Chamber of Shipping (ICS) announced its goal of achieving climate-neutral shipping by 2050. In 2018, the International Maritime Organization (IMO) had already set the target of reducing emissions by 2050 to a level at least 50% lower than in 2008. The EU is planning to reduce CO2 emissions and to put taxes on shipping even earlier.

Within the framework of its Emission Trading System (EU ETS), a CO2 tax for ships of 5,000 gross tonnage (GT) and above is to be introduced in the EU in three stages from 2024 to 2026. Some shipping companies, such as MSC, have already informed their customers about additional costs in the future. Container shipping companies have estimated the added costs at about $192 to $202 for a 40-foot standard container on the Northern Europe-U.S. East Coast route.

DSLV’s experts point out that it’s important that the introduction of a CO2 levy in the EU region must not lead to any competitive disadvantages. Equal competitive conditions in international shipping are crucial for global trade. In the opinion of shippers and shipowners, the IMO should implement global regulation in a timely manner.

In the meantime, the development of alternative fuels for shipping is still in its early stages. The production, distribution, and market ramp-up of sustainable alternative fuels, as well as the expansion of shore-side power supply in sea and inland ports, are important steps towards reducing greenhouse gas emissions on the way to climate-neutral shipping.

Green shipping

Shipping lines are increasingly employing modern ships with significantly improved environmental standards as well as new propulsion systems and more environmentally friendly fuels. There’s no doubt that investment in climate-friendly transport chains is on the rise.

Among the world’s largest carriers, companies such as Maersk already offer their customers special “green shipping offers.” EcoDelivery, for example, takes climate-neutral fuels into account. These are, for example, waste vegetable fats and oils from the food industry. The CO2 saved is certified for the shippers’ carbon accounting, while a total of 3% of Maersk’s total cargo volume was carried with climate-neutral fuels in third quarter of 2022.

The EcoDelivery surcharge for a 40-foot container in major trades, such as the Far East and trans-Pacific, was around $200 to $300 per box in 2022. If you convert that to, say, the 30,000 T-shirts or 6,000-8,000 pairs of shoes that can fit in such a box, at $0.007 per T-shirt, that’s not a huge added cost per unit of product.

The number of consigners interested in EcoDelivery is increasing steadily, according to the shipping company. According to Maersk, customers already using EcoDelivery include H&M, Electrolux, Lenovo, and the Danish fashion group Bestseller.

The shipping company recently ordered 19 container ships powered by climate-neutral green methanol. From June 2023 to 2025, one feeder ship and 18 large container ships with slot capacities of 16,000 TEU and 17,000 TEU will be put into service under the Maersk flag.

The carrier is also moving towards climate neutrality landside and is building or leasing very low-emission warehouses and using electric vehicles at its own terminals. To date, 300 e-trucks are already in use, mainly in the United States, and a further 140 e-trucks have been ordered.

More LNG terminals in Europe

The Russian war of aggression against Ukraine is making an impact on Europe’s energy supply security. In addition to finding new natural gas supply countries, the construction of LNG terminals is a priority. Now there are 41 LNG terminals located in several countries in Europe with a total capacity of 241 billion cubic meters—enough to cover around 40% of Europe’s natural gas demand. Another 32 LNG terminals are in planning in Europe.

Stationary LNG terminals are planned in four German ports, each of which is expected to handle around 13 billion cubic meters per year. Before they’re completed, four floating LNG terminals will be put into operation from the turn of 2023 on. Up to 22.5 billion cubic meters of LNG per year will then be imported through these facilities in the four German ports on the North Sea and Baltic Sea coasts.

Before December 2022, there was no terminal in Germany that could be used to discharge LNG tankers. Previously, only small amounts of liquefied natural gas had been imported by truck from other European ports—such as Rotterdam or Antwerp—that have been operating LNG terminals for several years.

The German LNG terminals now under construction will in the longer run become part of the infrastructure for importing hydrogen to help achieve climate neutrality. Low-CO2 energy sources including pure hydrogen and hydrogen derivatives such as ammonia will then be imported.

Wilhelmshaven is to become the “energy hub” for green energy on the German North Sea coast. Among other things, it’s planned to build an electrolysis plant to generate hydrogen gas and an ammonia cracker to reconvert climate-friendly produced ammonia into hydrogen.

Olaf Lies, Lower Saxony’s Minister of Economic Affairs, Transport, Building and Digitalization, recently stated: “The new LNG terminal is a major step towards a secure energy supply. The early decision to choose Wilhelmshaven as a hub for LNG imports was the right one. The existing port infrastructure and the excellent conditions have helped make the project a success.”

Europe’s largest green hydrogen plant will be built on Maasvlakte 2 in the Port of Rotterdam. Shell has made the final decision on investments for this new plant, which will be named Holland Hydrogen 1 and is expected to be operational in 2025.

The hydrogen generated there will supply the Shell Energy and Chemicals Park Rotterdam. This will partially decarbonize the facility’s production of fuels like gasoline, diesel, and jet fuel. As heavy-duty trucks are coming to market and refueling networks grow, renewable hydrogen supply can also be directed toward these to help in decarbonizing commercial road transport.

How to deal with China

Business with China is coming under pressure and there’s a huge emphasis in the United States and European countries on reducing dependence on China for trade. In particular, Chinese investments in global ports and terminals are being discussed.

There are military concerns, for example, that China’s port engagement can be critical to NATO operations, as well as data security worries, as China’s Ministry of Transport has installed a state-subsidized platform called Logink to monitor and digitally manage global logistics supply chains and data exchange between the ports.

Globally there are around 96 ports in 53 countries where Chinese companies own or operate terminal assets, according to research by Isaac B. Kardon of the U.S. Naval War College and Indiana University’s Wendy Leutert. U.S. ports include Miami; Houston; Long Beach; Los Angeles; and Seattle.

In Europe, COSCO and its sister company China Merchants Port already own terminals or shares in port operators in 14 European ports. COSCO’s port investment in Europe started in 2008, when it signed its first deal with the Piraeus Port Authority to operate two of the port’s three terminals. Since 2016, COSCO has become a majority stakeholder in the Piraeus Port Authority, which operates the port’s third terminal.

Chinese interest in Germany’s biggest port

Chinese stakeholding in seaports is increasingly becoming a political issue in Europe as well, as COSCO’s planned investment in the Port of Hamburg shows. COSCO Shipping Ports Limited had planned to buy a share of 35% of the port operating company of HHLA Container Terminal Tollerort.

After controversial debates, the German government decided to limit the share to 24.9%. COSCO has not yet agreed to the compromise, even though a first deadline was set for the end of 2022. At the time of writing, it’s not clear if there will be an extension or if COSCO may revoke its offer. That would have serious consequences for the Port of Hamburg, since China is its most important trade partner, responsible for over a quarter of the total throughput.

Hamburg is worried that China might shift its shipping to competing ports in the Netherlands, Belgium, and Poland, where COSCO, Hutchinson Ports, and China Merchants Port already own shares. To ensure fair competition in the future, the German Association of Ports is calling for a coordinated European stance on Chinese shareholding in terminals and port and logistics facilities as part of a common foreign and economic policy among EU member states.

Asia’s new emerging markets

Discussion is also intensifying in the United States against the backdrop of the trade war with China, the Taiwan conflict, and the supply chain disruptions caused by the ongoing pandemic problems in China. Leading manufacturers are increasingly considering alternatives elsewhere in Asia.

For example, Apple is rethinking its strategy. U.S. media such as the Wall Street Journal reported that the company has accelerated its plans to relocate part of its production outside China. India and Vietnam are cited as alternative locations for assembling Apple products. Both countries have been in the focus of global manufacturers, suppliers, and logistics providers who are seeking new opportunities for component production, final assembly and logistics services.

India, the world’s 5th-largest economy, is emerging as a manufacturing and logistics hub. The country offers a huge potential of human resources, but its weakness is its lack of infrastructure and high logistics costs.

According to Indian Union Minister for Road Transport and Highways, Nitin Gadkari, its logistics cost is at 16% to 18%, whereas it’s 8% to 10% in China and 12% in Europe and the United States. “We’re going to accept this challenge and reduce the logistics cost to 8-10 per cent,” he said, when the government introduced its National Logistics Policy last year.

The government under Prime Minister Narendra Modi is planning to expedite last-mile delivery by building 22 expressways across the country and using technology such as drones to strengthen the logistics sector. Faceless assessment has started in Customs, and e-way bills and FASTag are bringing more efficiency. Furthermore, the capacity of ports has been increased and the container vessel turnaround time has been cut from 44 hours to 26 hours.

Vietnam in the focus

In addition to India, Southeast Asia’s markets are becoming increasingly interesting for manufacturers, suppliers, and logistics companies. Vietnam in particular is developing into one of the leading e-commerce markets, which offers potential for both local and foreign investors and service providers.

According to the report “E-commerce beyond borders” released in 2022 by The Ninja Van Group, a leading express logistics company in Southeast Asia, Vietnam is the leading country in the region for online purchases, with an average of 104 orders per year per person. Around 74% of the survey respondents in Vietnam said that they have shopped several times from foreign websites, followed by Singapore (67%), Thailand (63%), Indonesia (62%) and Malaysia (61%).

“With strategic research demonstrating the development of the e-commerce and e-postal industries in Southeast Asia, we believe that the Vietnamese market is one of the countries with the most potential thanks to the sustainable and clear growth in recent years,” says Phan Xuan Dung, sales director of Ninja Van Vietnam.

In 2022, the company announced an investment of $50 million in automation technology and systems to enhance its parcel processing capabilities across its nine key parcel sorting hubs. Ninja Van expects to complete this by the second half of 2024 to increase the group’s overall operational productivity across Southeast Asia by 50%.

However, there are also global players such as FedEx who have an eye on the growing Vietnamese market. In December 2022, the company announced that it would help businesses in Vietnam take advantage of new cross-border trade opportunities from the Regional Comprehensive Economic Partnership (RCEP).

The RCEP is the world’s largest free trade agreement, covering 15 countries including Vietnam. Experts from FedEx, who spoke at the RCEP-focused conference in December, highlighted opportunities provided by the trade agreement and areas that Vietnamese businesses can tap into for potential growth.

“The RCEP offers significant opportunities for Vietnam’s businesses, including small and medium-sizes enterprises (SMEs), to accelerate cross-border trade and economic recovery,” says Hardy Diec, managing director of FedEx Express Indochina. “The conference aims at helping them better prepare and enhance their competitiveness as they expand to new markets or look to tap into the global value chain. The free-trade agreement may benefit Vietnamese businesses through tariff reduction and better access to inputs and raw materials.”

In the end

Global logistics with its worldwide supply chains will continue to be caught between politics, economics and ecology in the future.

The great concern about possible escalation of the war in the Ukraine and of the Taiwan conflict means that companies are already starting to look for alternatives. This will also change global supply chains.

Whether there will be more regionalization, or nearshoring, remains to be seen. The persisting question: Who will be the winners and the losers?