A new market study published by Global Industry Analysts Inc., (GIA) the premier market research company, today released its report titled "Footwear - Global Market Trajectory & Analytics". The report presents fresh perspectives on opportunities and challenges in a significantly transformed post COVID-19 marketplace.

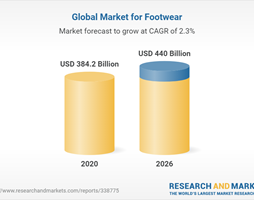

Amid the COVID-19 crisis, the global market for Footwear estimated at US$371.9 Billion in the year 2022, is projected to reach a revised size of US$421.4 Billion by 2026, growing at a CAGR of 2.9% over the analysis period. Casual Shoes, one of the segments analyzed in the report, is projected to grow at a 3% CAGR, while growth in the Athletic Shoes segment is readjusted to a revised 2.9% CAGR. Global consumption of footwear declined significantly in 2020 owing to the COVID-19 pandemic. The biggest decline in footwear consumption was anticipated to be in Europe, followed by North America, and Asia. In Italy, the sales of clothing and footwear declined to zero in stores that were not connected to the usan e-commerce platform after a nationwide lockdown was imposed in the country in March 2020. In the entire month of March, the sales of clothing and footwear declined substantially through all channels, both offline and online, and the export orders also reduced considerably. Major footwear export destinations, such as the United States of America and Europe, were severely impacted by the outbreak of the pandemic. Moreover, the lockdown restrictions disrupted the global supply chain, which fuelled the trend of reshoring. Countries such as Portugal, Spain, and Croatia benefited from the accelerated reshoring of manufacturing in Europe. Additionally, the transition of manufacturing from China to other countries is also expected to benefit countries such as Vietnam, although the pandemic has reduced the attraction of these destinations. Several countries, such as South Korea, Taiwan, and Japan, are striving to gradually reduce their reliance on China for manufacturing even before the pandemic, and the pandemic has accelerated that effort.

Footwear collections have become more casual and focused on comfort in the past few months as the footwear brands strive to cater to the new work-from-home lifestyles of the consumers during the pandemic. However, sales of dress shoes have registered a substantial decline compared to the previous year. Despite the reduction in sales of dress shoes and a big transition towards casual dressing, several footwear brand founders are optimistic about the prospects of heels, with pumps remaining the top-selling category for a number of brands. High demand for heels and other dress shoes has been attributed to the emotional purchases made by consumers, which implies that people are purchasing things that can bring them joy. Even before the pandemic, comfort has been a major selling point for the pumps of different brands. The pumps offer six mm of extra padding and an expanded toe box and have been manufactured to enable women to live their lives without compromising style. However, the overall sales of flats have registered a significant increase with the imposition of lockdowns at the initial stages of the pandemic compared to pumps. For instance, the sales of sandals have witnessed a record growth as consumers opted for more practical wardrobe options. The trend is expected to stay, which can potentially harm the prospects of heels as once consumers prioritized comfort over style, they are expected to stick to practical wardrobes.

The transition toward comfort clothing has started before the pandemic in line with the casual wear and athleisure trends in workplaces and the broader fashion industry. Thus, the dress shoe segment is not expected to fully recover as the sales have continued to decline in recent years even before COVID-19. The dress shoe business of most of the women's footwear brands has contracted significantly since the beginning of the COVID-19 pandemic, with several retailers of many brands having been stuck with excess inventory of dress shoes in recent months. These factors indicate the overall pressure on dress show business. For instance, a mule introduced by Margaux, a direct-to-consumer footwear brand, as part of their Gal Meets Glam spring collaboration has rapidly unseated the heel style as the top seller of the brand. High demand for the mule has forced the brand to reorder the style from their factories multiple times since its launch, with more than two-thirds of the mule pairs has been sold to first-time customers. The success of the style has prompted Margaux to recently introduce a mule outside their collaboration with three colorways, and every shoe comes topped with an oversized bow. In the next few months, footwear brands are expected to focus on casual boots and sneakers. For instance, footwear brand Jimmy Choo has launched the latest Hawaii trainer that witnessed a huge demand from the consumers.

Although customers of footwear brands are shopping more carefully and intentionally since the beginning of the pandemic, they are also shifting toward more fanciful styles, pastels, and prints than ever before. Previously, a significant share of customers, specifically the urban professional customers have been practical in their selection, with the sales of shoes in nudes, navy, and black registering a substantial growth in sales. However, the brands witnessed an instant increase in the sales of novelty items, such as shoes with prints and pop colors during the pandemic. Although customers have been shopping less during the period, they purchased items that can bring them joy. The shift has been in tune with other fashion trends as people are shopping for things such as bike shorts, bucket hats, or tie-dye that are lighthearted and fun and give them the same feelings when they wear them. Sarah Flint is planning to introduce a slipper in the upcoming months as part of a Cozy Interiors collection. Although the brand has planned for the collection before the pandemic, the slipper was later added to the collection considering the current preferences of consumers. Apart from the slipper, the collection also included a flat, a sleek heel, and an all-purpose boot. Women are expected to remain the main market for heels, whether they are buying pumps for a rainy day or a socially distanced night out.

China continues to dominate the world footwear production scenario, accounting for over 55% share of total production. The offshoring drive steered the Chinese footwear production during 2000s, and with active participation of domestic players, the momentum continues to remain upward. Though the business environment has changed in comparison to the recent past, Chinese companies are looking for remedies to bring back the lost interest of major footwear brands and companies. As a result, many Asian companies are independently developing high-quality footwear and associated products for addressing the demands of domestic markets. For instance, operation of shoe producers in Taiwan have undergone a transformation, with primary concentration now on the supply of luxury shoes, designing of footwear, and the setting-up of procurement and accounting centers for their production operations across the world. Several Chinese companies are also making huge investments in retail operations of Western footwear brands and companies to expand their global reach and market penetration. However, escalating costs in the Chinese manufacturing sector are likely to convert China's status from the world's footwear workshop to a major high cost footwear exporter to the world markets. Following several years of low prices for the goods exported from China, prices started rising against the backdrop of high inflation levels and production costs. But, for the global footwear industry, southern China is still an attractive footwear manufacturing market. The rising cost of manufacturing is nevertheless resulting in China losing its stronghold, with countries especially in Southeast Asia gradually gaining momentum and becoming a hub for the production of outsourced footwear.

Edition: 17; Released: June 2022

Executive Pool: 19111

Companies: 610 - Players covered include adidas AG; Reebok International Limited; ANTA Sports Products Limited; ASICS Corporation; Bata; Bata India Ltd.; Caleres; Deckers Brands; ECCO Sko A/S; Feng Tay Enterprises Co., Ltd.; Geox s.p.a; Gucci Group NV; Kenneth Cole Productions, Inc.; LaCrosse Footwear, Inc.; Nike Inc.; Nine West; Power Athletics Limited; Puma SE; RG Barry Corporation; Timberland LLC; Vans, Inc.; Weyco Group Inc.; Wolverine World Wide, Inc. and Others.

Coverage: All major geographies and key segments

Segments: Product Segment (Casual, Athletic, Outdoor/Rugged, Dress/Formal, Footwear Accessories); Distribution Channel (Retail, Online); End-Use (Men, Women, Children)

Geographies: World; USA; Canada; Japan; China; Europe; France; Germany; Italy; UK; Spain; Russia; Rest of Europe; Asia-Pacific; Australia; India; South Korea; Rest of Asia-Pacific; Latin America; Argentina; Brazil; Mexico; Rest of Latin America; Middle East; Iran; Israel; Saudi Arabia; UAE; Rest of Middle East; Africa.