Purchasing officers now prefere Turkey [for European markes], and China [in its home market]. Preferences for Ethiopia, and Vietnam fall significantly. Data shows it’s part of a larger nearshoring and reshoring pivot in fashion to bring their supply chains closer to home. [Why now and for how long? – Vogue]

PVH chief supply chain officer Sarah Clarke announced the company would be closing down its operations in the Hawassa Industrial Park, a major manufacturing plant run for over five years and the first of its kind in Ethiopia, where PVH employed approximately 1,450 of the site's 30,000-person workforce as of last week.

Due to the “speed and volatility of the escalating situation” surrounding the national emergency in Ethiopia, PVH said that it had given up on its attempts to transition its facility within the park over to a third-party supplier and it was arranging transport for their foreign-national employees to leave the country. PVH will still source from third-party manufacturers in the park. As part of a statement to Vogue Business, a spokesperson for PVH said that “they were proud of the work they had done there,” echoing the sentimentality expressed by Clarke, who recognised the park’s performance in “creating pathways to opportunity and choices for women”.

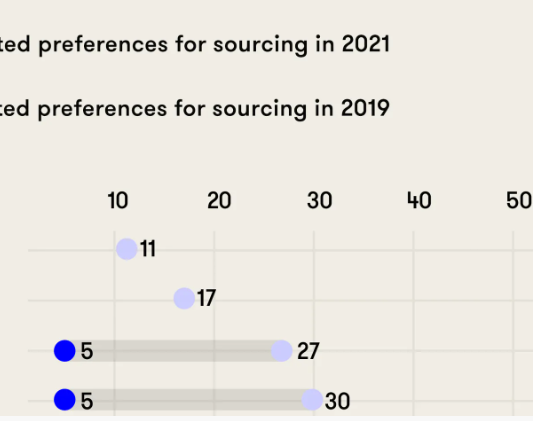

The closing of the Ethiopian facility comes within days of a 2021 McKinsey report that shows Ethiopia dropping sharply out of favour among major apparel purchasing officers. In 2019, the country was among the top five nations where brands said they were considering expanding their manufacturing, according to an earlier McKinsey report that surveyed 64 brands. This year, only two purchasing officers of the 38 surveyed — who altogether account for roughly $100 billion in sourcing volume — would consider it within their top three choices for expansion, as detailed in additional McKinsey research reviewed by Vogue Business.

Closures such as PVH’s in Ethiopia may be the tip of the iceberg for off-shore manufacturing sites. Last year, 2020 has already seen Nordstrom move its private-label volume production to Guatemala, and Benetton is reducing its reliance on manufacturing in Asia in favour of Turkey, Egypt and Balkan countries, as recently reported by Reuters. “[Nearshoring] has increased its popularity over the past months, due to the recent capacity shortages, bottlenecks in global logistics infrastructure and increasing global demand,” says Carolin Westermann, head of global corporate comms for Hugo Boss. “Since this current situation is a phenomenon, that is impacting any business and industry around the globe.”

Three-quarters of fashion companies surveyed by McKinsey see shipping disruptions as the greatest threat to flexibility and speed. Seventy-one per cent say they are looking to increase nearshoring by 2025 — bringing manufacturing sites closer to their consumer market — and 24 per cent say they are planning to reshore manufacturing to the same country of operation as the brand, according to McKinsey. Many purchasing officers indicated that disruption in raw-material supply and geo-political supply chain risks were an important concern amongst shipping delays. An overall increase in demand volatility also weighs heavily with many brands concerned over speed and supply-chain flexibility. McKinsey also found that competition from fast-fashion players and the demand for more responsible consumption, as well as a growing online share were among reasons for adjusting future supply chain plans.

“Brands are on the lookout for more flexible supply chains, more nimble supply chains — but it’s a broader idea than shorter,” says Matt Powell, an analyst of apparel and footwear and senior advisor for market research firm NPD. “We used to have a ‘just-in-time’ supply chain, where companies didn’t want to own any inventory, they wanted to turn that inventory around as soon as the ship hits the soil, and I think we are moving to a ‘just-in-case’ mentality, where they are expecting some kind of flare-up.” Powell points to political uprising and further outbreaks of Covid as risk factors. “They want to be as flexible as they can be.”

Demand-volatility is one of the top reasons purchasing officers gave for adapting their supply chains, with post-lockdown recovery and demand spikes straining production and transportation capacities. “In highly discretionary categories like apparel, footwear and accessories, demand just went away in April 2020. April was the worst month I’ve ever seen in 20 years... and then June was the best month I’ve seen in 20 years,” says Powell.

Apparel imports from Ethiopia to the US continued to demonstrate this volatility long after pandemic restrictions eased, with significantly deeper changes, month-to-month, including during the shipping crisis in the Suez Canal, according to UN Comtrade data reviewed by Vogue Business. Jim Shea, chief commercial officer at First Insight, a voice-of-customer predictive analytics firm, points to the demand volatility as being related to a bullwhip effect, where increasing swings in inventory occur in response to shifts in consumer demand as one moves up the supply chain in apparel sourcing: “That has been accentuated on the supply side by the factory shutdowns due to Covid. The amplitude of the whiplash is greater because of the long distances between the supply and the demand. Onshoring brings the supply closer to the demand signal for faster, more efficient response to changing consumer preferences.”

Brands with more localised supply chains say they benefit from the proximity. For Hugo Boss, having a production site with 3,500 employees in Izmir, Turkey, is a competitive advantage because it offers agility and flexibility in their supply. “We plan to further strengthen its role in the future, in the context of our nearshoring approach… Today we already supply over 40 per cent of our global supply chain from the EMEA region… This helped us throughout the pandemic and it will remain highly relevant for us in the upcoming years throughout our Claim 5 growth plan,” says Westermann.

There are wider positive social implications from the movement of manufacturing into the same market as the consumer. “The shorter transport routes increase sustainability while lowering greenhouse emissions. Nearshoring also allows more flexible in-season production, which helps to reduce overproduction,” says Saskia Hedrich, co-author of the McKinsey report.

As companies reconsider their manufacturing sites and partners, pullouts will need to be considered, particularly given the Covid-19 fallout that left many global suppliers unpaid. PVH took action beyond their responsibilities during the closure of its manufacturing site in Ethiopia, meeting with Ethiopia’s Industrial Federation of Textile, Leather and Garment Workers’ Trade Union (IFTLGWTU) and agreeing after consultation to pay its considerable workforce three months’ salary over the legal requirements.

As Shea points out: “A key learning is that the lowest labour and material cost option isn’t always the best option.” Informed by his research for First Insight, Shea maintains that Gen Z value sustainability and fair work practices, and are willing to pay more for brands that align with their personal beliefs. From this principle, he says that onshoring is a trend that will continue to grow. “Retail needs to take this pandemic as an opportunity to change and to learn to do things differently.”