Fashion’s been heeding the call of technology for years—and the industry’s future is looking even more digital, with fashion companies expecting to double tech investments by 2030 to stay competitive. There are many ways they can apply innovative digital resources to better serve customers and increase business efficiency. Where are executives leaning in, and what are opportunities for creatively using robotics, AI, and other technologies to their advantage? McKinsey’s State of Fashion Technology Report 2022 dives deeper on the dynamics and highlights five key technology themes with potential.

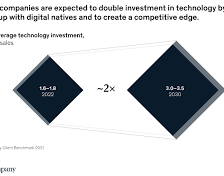

In 2021, fashion companies invested between 1.6 and 1.8 percent of their revenues in technology. By 2030, that figure is expected to rise to between 3.0 and 3.5 percent. Behind the predicted increase is a conviction among many that technology could create a competitive edge—in customer-facing activities, where companies have mostly focused to date, and, more increasingly, in operations. Technologies such as robotics, advanced analytics, and in-store applications may help streamline processes and support sustainability, as well as create an exceptional customer experience (exhibit).

Consumer digital engagement rose sharply during the COVID-19 pandemic, as a result of more hours spent online, new shopping habits, and rising interest in gaming and virtual worlds. In 2021, people spent on average just below four hours on their mobile phones, which includes about two and a half hours of scrolling though social media.1 Of the fashion customers who made the move to online-shopping channels in 2021, 48 percent said the pandemic was the reason, 27 percent cited convenience, and 11 percent cited product availability and promotions.2 The pandemic also boosted digital brand relationships, with 72 percent of customers reporting they interacted with brands online in 2021. In the year ahead, as restrictions ease in some geographic areas, digital interactions will likely stabilize at about 66 percent on average.3

Looking ahead, the impact of technology on people’s lives may accelerate. By 2024, AI-generated speech could power more than half of human interactions with computers, McKinsey analysis shows. Soon after, more than 75 percent of enterprise-generated data could be processed by cloud or edge computing. This offers a more flexible, scaleable foundation on which brands can potentially build their tech offerings. By 2030, more than 80 percent of the global population is expected to have access to 5G networks, enabling, among other things, faster connectivity and data transfer across Internet of Things devices.

The operational potential of technology is becoming ever more apparent. McKinsey analysis shows that fashion companies that now embed AI into their businesses models could see a 118 percent cumulative increase in cash flow by 2030. Conversely, those that are slower to invest in digital technology will lag behind—and could see a 23 percent relative decline. Over the next three years, potential key areas in which fashion executives could make digital investments are personalization, store technologies, and end-to-end value chain management—areas in which digital can make a real difference to performance.

Fashion’s five key technology themes

As fashion industry executives consider how to maximize their technology resources, McKinsey and the Business of Fashion have identified five key themes that could help the industry address some pressing challenges, as well as unlock potential opportunities: metaverse reality check, hyperpersonalization, connected stores, end-to-end upgrade, and traceability first.

Metaverse reality check. The marketing value of digital fashion and nonfungible tokens (NFTs) may now be clear, but fashion brands will need to separate the concrete opportunities from the hype to generate sustainable revenue streams presented by growing consumer engagement with the metaverse.

Hyperpersonalization. Brands have access to a growing arsenal of personalization tools and technologies to upgrade how they customize and personalize their customer relationships. The opportunity for executives now is to harness big data and artificial intelligence to provide one-to-one experiences that build long-term loyalty.

Connected stores. The inexorable rise of e-commerce has forced fashion players to rethink the role of physical stores. Fashion executives can address consumer pain points by using in-store mobile apps to enhance the in-store experience and microfulfillment technologies to leverage the store for the quick-commerce era.

End-to-end upgrade. Digital tools and analytics have transformed key parts of the fashion value chain, but these optimizations are often siloed within organizations, limiting the potential of cross-functional improvements. Brands should embark on end-to-end value chain integration to create more efficient and more profitable ways of operating.

Traceability first. Traceability systems powered by traceability software and big data will help fashion brands reach far into their supply chains to understand the entire life cycle of their products, a key enabler for sustainability road maps.

Of all the technology-based evolutions affecting the fashion industry, one of particular interest is virtual worlds, also known as the metaverse. Global spending on virtual goods reached more than $100 billion in 2021, more than doubling the total in 2015, with around 30 percent of revenues attributed to virtual fashion assets. Amid demand for products such as virtual fashion and NFTs, fashion companies focused on metaverse innovation and commercialization could generate more than 5 percent of revenues from virtual activities over the next two to five years. The task for decision makers, however, will be to focus on specific opportunities.

For many fashion brands, highly personalized customer experiences are a cornerstone of their digital businesses. Their customers expect nothing less. Advancements in AI, analytics, and cloud computing mean that businesses have the tools to work with all types of data across channels in real time. This could support a move to hyperpersonalization, in which technology could help search-based e-commerce transform into individualized discovery of products and styles. This may enable customers to routinely access curated websites and marketplaces, from landing pages to payments. To make that vision a reality, decision makers may need to optimize their data and analytics capabilities and roll them out at scale. While this may create some important considerations (for example, to ensure that customer data is protected and that data collection follows best practices), the upside could be the ability to acquire and retain loyal customers.

In parallel to personalization, the coming year will likely see many brands investing in in-store functionality and experiences, bridging the gap between online and offline channels—and moving away from stand-alone technologies such as magic mirrors, connected hangers, and interactive holograms. In-store mobile “clienteling” apps could offer a frictionless way for store associates to serve customers, while in-store mobile apps can help boost engagement, reduce customer pain points, and increase time spent browsing. Beyond the shop floor, robotics and stock optimization software can help brands and retailers set up microfulfillment centers, integrating physical stores as digital nodes in their distribution and delivery networks and cutting fulfillment costs by up to 90 percent.

From demand forecasting to transport operations, a critical element in expanding the role of technology could be to apply digital tools to make end-to-end improvements in the value chain. To operate more efficiently, brands could consider breaking down the silos that have defined many digitization programs and integrating multiple back-end systems, workflows, and data functions. More than 60 percent of fashion executives believe creating integrated digital processes throughout their organizations will be among their top five areas for digitization as they look to 2025. By adopting digitally enabled value chain solutions, brands could see a 50 percent reduction in time to market, an 8 percent rise in full-price sell-through, and a 20 percent decline in manufacturing costs, our analysis shows.

- More than 60 percent of fashion executives believe creating integrated digital processes throughout their organizations will be among their top five areas for digitization as they look to 2025.

More than 50 percent of fashion decision makers say traceability will be a top-five enabler of reducing emissions in their supply chains, but many brands currently have visibility over only direct supplier relationships. We see brands increasing their focus on traceability through their supply chains, helping them address demands from regulators, investors, and customers for greater transparency. As they aim to cut emissions and meet their environmental, social, and governance (ESG) targets, brands could benefit from a common data language to enable comparability, as well as new labeling standards and tracking software. Brands could consider joining forces with peers, start-ups, and industry bodies to establish a common data standard and to share data and knowledge via software platforms, open ledgers, and big data technologies.

One of the few certainties in fashion is that nothing stays the same, and the opportunities offered by technology are continuing to evolve as some markets look to move beyond the challenges posed by the COVID-19 pandemic. The task for fashion decision makers is to consider how to harness technology to creativity, streamline operations, and create value from innovation that can be sustained in the years ahead.