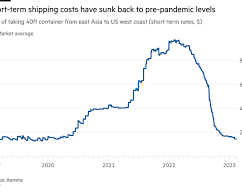

Container shipping costs plunged in the last year as inflation slowed consumer spending. The widespread bottlenecks at ports — at one point last year more than 100 ships were waiting to dock at the Los Angeles port — have also largely dissipated, the Financial Times reported.

As a result, shipping a 40ft steel container from eastern China to the West Coast of the U.S. now costs $1,444, down from a peak of $9,682 in March last year. According to Deloitte, a consulting firm, demand for goods in the U.S. will slow in 2023 amid high interest rates.

Shipping group Maersk predicts that demand for containers — a proxy for trade — will fall by 2.5 per cent this year.

The S&P monthly survey of purchasing managers indicated that new export orders contracted across the world throughout the second half of last year and in January. Last month, the IMF forecast that global trade growth would decline to 2.4 per cent this year, from 5.4 per cent in 2022.

With many clients on long-term contracts, which have proven less volatile than short-term rates, shipping groups are likely to retain the benefits of higher rates for at least the current quarter before new agreements reflect the decline in prices.

In a bid to put a floor under freight rates, groups are also cutting sailings. In 2022, carriers cancelled or skipped 1,639 shipments between east Asia and Europe or North America, a 40 per cent increase on the previous year, according to data provider eeSea.

Despite this, the drop-off in shipping volumes leaves companies with a looming overcapacity problem.