Since the beginning of the COVID-19 pandemic, South Asian Networking on Economic Modelling (SANEM) has been conducting a quarterly survey to get an accurate picture of the business environment of Bangladesh. SANEM has been conducting this survey titled ‘Business Confidence Index’ since July 2020. Seven sub-sectors from manufacturing sectors: RMG, Textile, Leather and Tannery, Pharmaceutical and Chemicals, Food Processing, Electronics and Light engineering and eight sub-sectors from the services sector: Retail, Wholesale, Hotels and Restaurants, Financial Sector, ICT, Transport, Real Estate were included in the survey. 502 firms across the country have been surveyed from 3 to 24 January 2022.

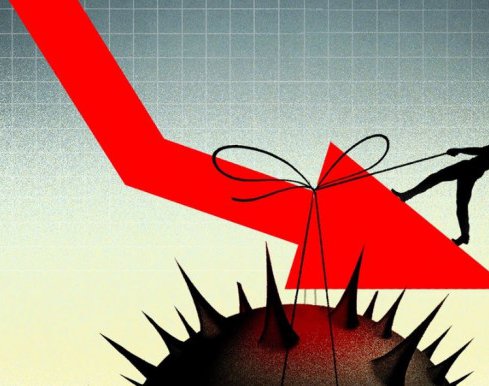

Despite an over 60% recovery in December last year, the overall business expectations in the January-March quarter might register a fall as rising fuel costs and a resurgence in Covid-19 infections are weighing on the pandemic recovery, forecasts South Asian Network on Economic Modelling (Sanem).

The local research firm in its latest survey of businesses, seventh round in a series since the outbreak of the coronavirus, finds about 17% of entrepreneurs are confident about a strong recovery in January of the current fiscal year, while it was 21% in the previous round in October.

Similarly, their views on moderate recovery have fallen to 44% in this round from 52% in the previous round of survey.

In the sixth round of the nationwide survey on 500 firms, held on 10-27 October 2021, a robust rebound was predicted as 21% of respondents said Bangladesh was on a path of strong recovery, while it was only 9% in the previous round. The share of hopefuls for a moderate recovery also rose significantly.

Sanem has now identified some challenges, such as fuel price hike, inflationary pressure, a new wave of Covid-19, falling remittances and a wider coverage of vaccination, which are affecting the economic recovery process.

Sanem prepares the Business Confidence Index (BCI) using six indicators – profitability, investment, employment, wage, business cost, and sales, including exports – to forecast the level of business confidence in a quarter by comparing data of the previous quarter. The latest findings of the survey were shared on Monday.

The seventh phase of the survey that Sanem carried out on 502 firms under the manufacturing and service sectors in 38 districts across the country showed a gap between firms' expectations and reality where they were unable to meet the expectations in October-December.

However, they are attempting to revise their expectations based on the current reality.

Addressing the challenges associated with Covid-19, the study recommended developing sector-specific protocols for managing the pandemic situation, accelerating the vaccination programme and considering pragmatic stringent policies.

While presenting findings from the seventh round of the "Business Confidence Index" survey conducted in January this year at a webinar, Dr Selim Raihan, executive director of Sanem, emphasised faster disbursement of stimulus packages, easing access to stimulus packages and government support focusing on specific requirements of firms.

Identifying the fuel price hike as a major concern for economic recovery, Selim Raihan suggested relaxed taxation on imports of oil and strategic, dynamic and forward-looking fuel price policy.

Focusing on SMEs, the study proposed proper assessment of the impact of the stimulus packages, facilitation of further credit and easy access to finance, supply-side support to reduce institutional deficiency and promoting and extensive implementation of the credit guarantee schemes offered by the Bangladesh Bank.

The survey covered manufacturing sector ventures, such as garments, textiles, leather and leather products, pharmaceuticals, light engineering and food processing industries. The survey also included wholesale and retail business, restaurants, transport, ICT and telecommunications, financial sector and real estate sector.

According to the survey, these companies have made comparative improvement in business activities in the October-December 2021 quarter with faster recovery observed in RMG, textile, restaurant, food processing, and pharmaceuticals sectors year-on-year.

In relation to the impact of Omicron, about 71% of the firms have reported a decrease in export orders or sales, followed by 79% of firms reporting additional health measures and associated cost hikes and 82% of firms reporting an increase in input costs. Omicron has also increased the risk of decrease in exports as reported by 89% firms, the risk of additional health measures and associated cost increase as reported by 90% firms and the risk of increase in input costs as reported by 91% firms.

The impact of fuel price hike has also been significant. Some 97% firms reported an increase in transportation cost and 79% firms reported an increase in energy cost. The fuel price hike has also increased the risk of increase in transportation cost as reported by 94% firms and the risk of increase in energy cost as reported by 81% firms.

The survey also states that the Enabling Business-environment Index (EBI) in the last quarter has reported an overall improvement after a dip in the July-September 2021 quarter. The index was made based on 10 indicators: Electricity (connection and quality), availability of skilled workers, transport quality, business or property registration, access to finance, overall tax system, government support for the industry, management of the Covid-19 crisis, trade logistics (port and customs) and corruption.

Meanwhile, the EBI has fallen across leather, wholesale and real estate sectors.

The business confidence survey pinned down consecutive waves of Covid-19, increase in input prices, supply chain disruption, and decline in sales of export orders as some of the major difficulties in the recovery phase.

As per the survey, some 65% of the surveyed firms said further government support to improve business confidence is required, which includes providing low-interest working capital loans, introducing pre-shipment refinance facilities for exporters and social safety net programmes for hapless workers.

Sanem recommended that the government focus on improving the business environment and take a special economic zones-based approach.

The government should also strike a balance in the coordination between fiscal and monetary policy to ensure a stable inflation rate in the mid-term, it added.

As remittance flow has been falling, the study advised assessment of remittance flow and increasing cash incentives from 2.5% to 3%.